Lump sum loan repayment calculator

Lowering monthly payments. If youve decided to work on paying off your debt remember that early lump sum payments make a big difference.

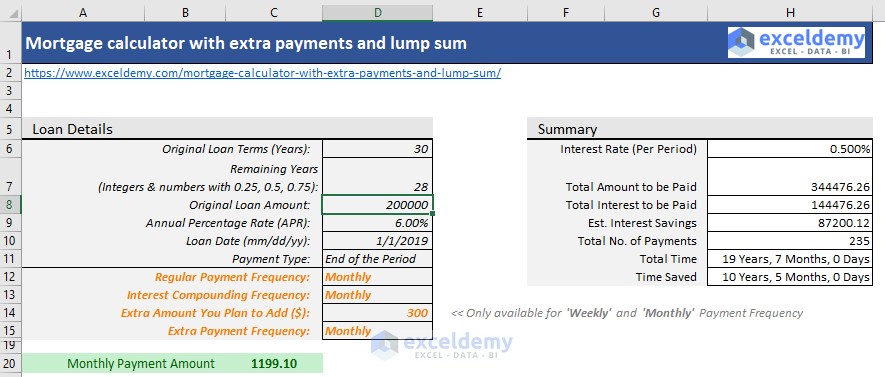

Extra Payment Mortgage Calculator For Excel

If you refinance 30000 of student loans at a 325 interest rate with a 10-year repayment term you can save 4789 over the life of your loan.

. An offset account is an everyday banking account thats linked to your home loan where you can deposit your savings and your regular wages. If youve received a lump-sum payment from an inheritance tax refund or commission from a sale youre probably considering how to best use the money. Enter your HELOCs annual percentage rate APR.

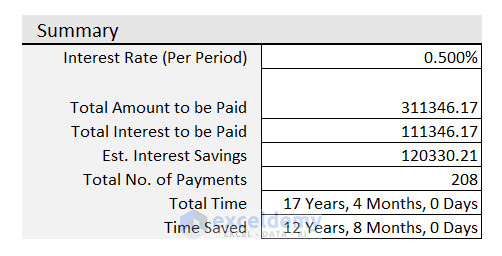

By wiping out a big chunk of principal your total interest savings will skyrocket because of the compound effect. Home loan repayment calculator. Our mortgage calculator makes it easy to find out what the monthly fortnightly and weekly repayments will be for any loan.

Use our student loan calculator to estimate monthly student loan payments payoff term length interest rates best repayment options and more. How to use this personal loan calculator. Follow these steps to calculate the monthly payment and total cost of a personal loan.

Use this calculator to. Early Lump Sum Repayments Make A Big Difference. Enter your loan term.

What if I paid an additional per month. This also increases the chances of refinancing out of a variable rate loan as the equity in the home rises. A balloon payment occurs when the lender decides that they want a lump sum of money at some course over the life of the loan.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. What if I made a single lump-sum payment of. The payment is applied during the third year of the loan.

You could be paid off in years or payments months early. What to know about loan repayment. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Income-Based Repayment IBR Calculator Recommended for. Enter your loan amount. These stipulations are always set in place prior to the final terms of the loan being presented to the borrower before signing.

This student loan lump sum payment calculator shows how much you save and how much faster you pay off your student loans when you make a lump-sum payment. At the start of a loan the majority of your repayment is usually going to be interest whilst towards the latter half of your loan term and having paid down the loan significantly the principal is the primary component and your loan balance will reduce substantially with each repayment. Please note the loan calculator is intended to give an.

For the loan term. Use our home loan calculator to estimate what your monthly mortgage repayments could be. Most loans are installment loans meaning that you receive a lump sum of money upfront that you pay back through a course of monthly payments.

Most repayment periods for HELOCs range from 10 to 25 years. How our mortgage calculator works. Unlike fixed-rate mortgages ARM loans will reset at a predetermined length of time depending on the loan program.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. The less principal involved in a debt the less interest youll pay. The Loan Repayment Calculator is designed to provide an estimate of payments and results received from this calculator are designed for informational purposes.

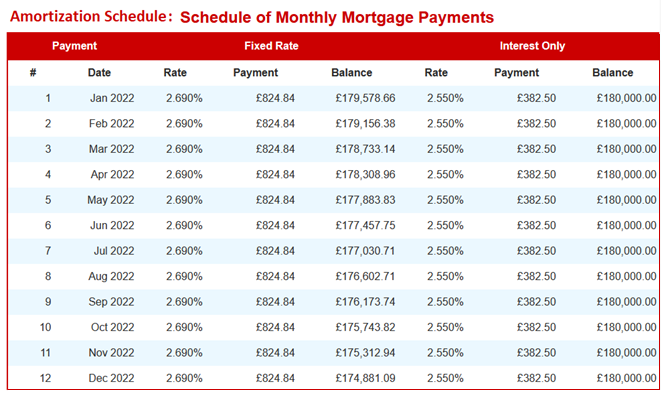

Use our extra and lump sum repayment calculator to see how making extra repayments can reduce your loan amount. Rounding of repayment amounts We use the unrounded repayment to work out the amount of interest youd pay over the mortgage term. The following chart shows how much you can save based on a one-time lump-sum payment of 60000.

Depending on the loan you may be able to increase your regular repayment so youre simply paying off a bit extra each month fortnight or week or you may also be able to make one-off extra lump sum repayments in the event that you have some extra cash at a particular time eg. When you get your tax return. Enter the length of your repayment period not your draw period.

The SBI Home Loan Prepayment calculator helps you in understanding the amount you manage to save by reducing your tenure. Youll also repay the loan sooner freeing up extra cash at the end. Personal loans typically range from 2000 to 50000 though some providers offer loans as low as 1000 and as high as 100000.

30-Year Fixed Mortgage Principal Loan Amount. Unlike an interest only loan PI repayments require a. Payments on home equity loans vs.

A partial prepayment can be done in two ways either by repayment of a lump sum of the loan amount or repaying the lump sum amounts at periodic intervals maybe once in a couple of months. Simply enter the loan details into the mortgage calculator below to see projected mortgage payments based on the type of home loan and your mortgage repayment frequency. The other way to make extra repayments into your loan is by using an offset account.

Enter the amount you want to borrow. Maybe part of your commercial loan package includes a balloon payment. A home equity loan is a lump sum of money with a fixed interest rate so your.

Your Investors mortgage loan will transfer to Citizens on Oct. Whether youre refinancing or just wanting to understand how much you can afford all you have to do is enter how the amount you would like to borrow interest rate home loan term payment frequency and repayment type either principal. Full usage instructions are in the tips tab below.

Home Loan Repayment Calculator Loan Payment Calculator. Paying down more principal increases the amount of equity and saves on interest before the reset period. Top Picks For Student Loan.

Our straightforward loan calculator helps you discover the total cost of any loan in just a few clicks. Lump Sum Extra Payment Calculator Recommended for. You get a lump sum upfront.

Monthly repayments We divide the mortgage amount and the total interest youd pay by the number of months you want to repay the money over. Its crucial to calculate the monthly and total repayment amounts before you apply for a loan. Estimating savings by making one-time extra payments.

For the interest rate.

Extra Payment Calculator Is It The Right Thing To Do

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Fixed Variable Rate Uk Mortgage Repayment Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage With Extra Payments Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Extra Payment Calculator Is It The Right Thing To Do

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Balloon Loan Calculator Single Or Multiple Extra Payments

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Repayment Calculator